When the NPV is positive, the project is considered financially viable; when negative, it’s not. Let’s consider an investment project with an initial cost of $100,000 and expected cash inflows of $30,000 per year for five years. By discounting these cash flows at different rates, we can construct the NPV Profile. For instance, at a discount rate of 10%, the NPV might be $12,000, while at a discount rate of 15%, the NPV could be $5,000. This information helps decision-makers assess the project’s viability and make informed investment choices. NPV is an important tool in financial decision-making because it helps to determine whether a project or investment will generate a positive or negative return.

Positive NPV vs. Negative NPV

This article aims to provide an in-depth understanding of what a net present value profile is and how it can be used to evaluate investment opportunities. In summary, NPV profile analysis provides a dynamic view of investment projects, allowing decision-makers to assess risks, uncertainties, and potential rewards. By combining quantitative analysis with qualitative insights, organizations can make informed choices that align with their strategic goals.

NPV vs. Payback Period

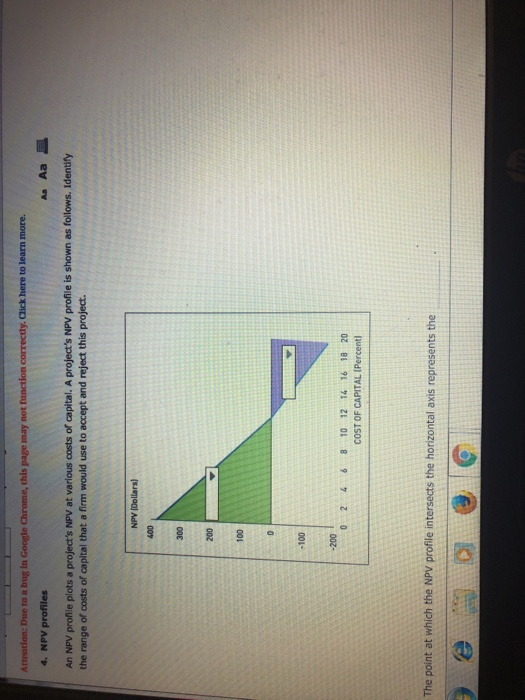

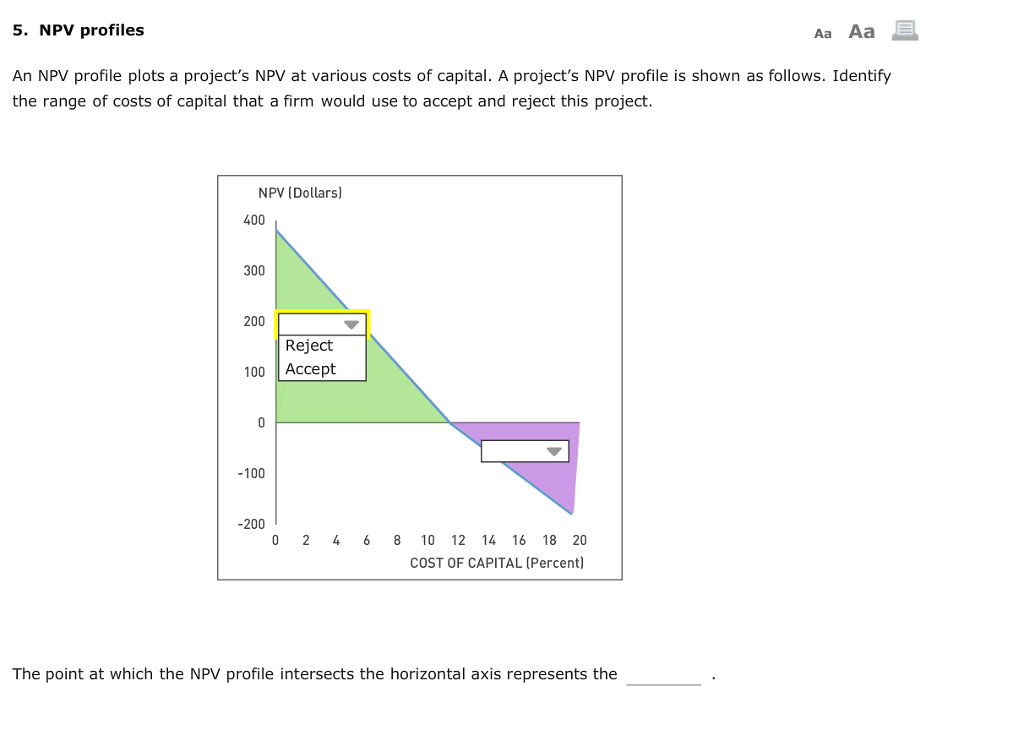

The NPV Profile is a graphical representation that illustrates the relationship between the discount rate and the net present value of a project. It provides valuable insights into the sensitivity of an investment project to changes in the discount rate. The NPV profile shows how NPV changes in response to changing cost of capital. Looking at the different NPV (Net Present Value) profile values, it is conveyed that Project A performs better at 18.92% and 20%. On the other hand, Project Y performs better at 5%, 10% as well as 15% as the discount rate increases the NPV declines.

Investment Appraisal

How about if Option A requires an initial investment of $1 million, while Option B will only cost $10? This concept is the basis for the net present value rule, which says that only investments with a positive NPV should be considered. The NPV method can be difficult for someone without a finance background to understand. Also, the NPV method can be problematic when available capital resources are limited.

Higher discount rates indicate the cash flows occurring sooner, which are influential to NPV. The initial investment is an outflow as it is the investment in the project. One limitation of NPV is that it relies on accurate cash flow projections, which can be difficult to predict. It also assumes that cash flows will be received at regular intervals, which may not always be the case.

How confident are you in your long term financial plan?

The 5% rate of return might be worthwhile if comparable investments of equal risk offered less over the same period. The internal rate of return is the discount rate that makes the net present value of a project equal to zero, representing the project’s expected rate of return. In summary, exploring the NPV profile helps decision-makers understand the trade-offs between risk, cash flow predictability, and project duration. By examining its components, we gain valuable insights into investment project dynamics. By considering the time value of money and the magnitude and timing of cash flows, NPV provides valuable insights for resource allocation and investment prioritization. It is the discount rate at which the NPV of an investment or project equals zero.

- Constructing an NPV profile assumes that cash inflows and outflows occur at different time periods and that the discount rate remains constant throughout the project’s life.

- The net present value rule is the idea that company managers and investors should only invest in projects or engage in transactions that have a positive net present value (NPV).

- Always interpret NPV results in conjunction with other metrics and qualitative factors.

- It helps determine whether a particular project is expected to generate positive or negative returns.

- The IRR and NPV can, in fact, produce different ranking outcomes whenever mutually exclusive projects are involved.

NPV allows for easy comparison of various investment alternatives or projects, helping decision-makers identify the most attractive opportunities and allocate resources accordingly. The time value of money is a fundamental concept in finance, which suggests that a dollar received today is worth more than a dollar received in the future. Businesses can use NPV when deciding between different projects while investors can use it to decide between different investment opportunities.

When faced with multiple investment opportunities, decision-makers can employ new able account advantagess to rank projects. Capital rationing becomes a strategic exercise, where projects compete for limited funds. In the realm of investment analysis, the Net Present Value (NPV) profile stands as a powerful tool that transcends mere numerical calculations. It is more than just a financial metric; it is a compass guiding decision-makers through the intricate landscape of investment projects. As we delve into the depths of this topic, let us explore the multifaceted facets of NPV profiles and their implications.

For independent projects, both NPV and IRR analysis yields the same decision. NPV profile shows the sensitivity of a project’s NPV for different discount rates. It is plotted on a graph where NPVs are on the y-axis with the discount rates on the x-axis. Both NPV and ROI (return on investment) are important, but they serve different purposes. NPV provides a dollar amount that indicates the projected profitability of an investment, considering the time value of money. Conversely, ROI expresses an investment’s efficiency as a percentage, showing the return relative to the investment cost.

The difference between the present value of the cash inflows and the present value of cash outflows is known as net present value (NPV). NPV provides a comprehensive view of project profitability, considering both timing and risk. By mastering NPV calculations, project managers and investors can make informed decisions and allocate resources wisely. Remember, the devil is in the details—accurate cash flow estimation and appropriate discount rates are critical for reliable NPV assessments.